Africa’s lubricants industry is on the move. The continent’s growing vehicle population, industrial expansion, and infrastructure investments are fueling steady demand across both automotive and industrial segments. Yet, as consumption rises, so does the complexity of reaching the end user. For lubricant marketers and distributors, the next phase of growth will not be defined solely by price or product quality but will be determined by how effectively companies navigate Africa’s unique route-to-market landscape.

A Market on the Move

• With total lubricant consumption estimated at 2.5 - 3 million tonnes annually and growing at 2–4% per year, Africa remains one of the few regions globally with consistent upward potential. Growth is fueled by powerful long-term trends like rising motorization, expanding middle classes, infrastructure investment, and rapid urbanization.

• Across major cities and capitals, the road networks are busier than ever, filled with imported used cars, motorcycles, and delivery vans. In parallel, industries such as mining, manufacturing, and construction continue to anchor lubricant demand on the industrial side.

• However, beneath this growth lies a fragmented, uneven market, indicating that there is no single “African market” but rather a patchwork of interconnected opportunities with each requiring a tailored route-to-market strategy.

Understanding the Structural Complexity

• To succeed, it helps to view the continent through three broad lenses: developed hubs, emerging volume markets, and frontier economies.

Mr. Samir Akoury

• Developed hubs such as South Africa, Egypt, and Morocco have mature lubricants sectors. They are characterized by strong competition, established distribution channels, and advanced consumer expectations.

• Emerging volume markets like Nigeria, Kenya, Tanzania, and Ghana are where growth is fastest. These countries have expanded automotive fleets but still rely heavily on importers and distributors to reach fragmented retail outlets.

• Frontier markets such as Zambia, DRC, Angola, Mozambique, and Ethiopia offer high potential but present logistical and infrastructure challenges, from long supply routes to inconsistent energy access.

Africa’s growing vehicle population, industrial expansion, and infrastructure investments are fueling steady demand across both automotive and industrial segments.

• The diversity of these markets creates a web of challenges: fragmented retail networks, inconsistent import regulations, counterfeit products, and the persistent difficulty of reaching consumers beyond major urban centers. For most lubricant brands, distribution is both their biggest opportunity and their biggest pain point.

Traditional Distribution Models— and Their Limits

• Historically, Africa’s lubricants trade has relied on distributor-led models. Importers and local wholesalers have long-controlled market access, managing relationships with retailers, mechanics, and workshops. For decades, this model worked well: it minimized capital investment for international brands and relied on the deep local influence of traders.

• However, it also created structural dependencies. Many marketers struggle with limited brand visibility, inconsistent pricing, and weak control over how products are represented. In many cases, distributors carry multiple brands, diluting loyalty and customer focus.

• Fleet and industrial partnerships (particularly in mining and manufacturing) offer better margins but remain concentrated on a relatively small customer base.

The Shift to Hybrid and Direct Models

• As the market evolves, brands are shifting towards hybrid RTM and direct-to-customer models that give them better control over supply chains and pricing.

• More players are establishing blending plants to reduce landed costs, hedge against forex volatility, and signal long-term

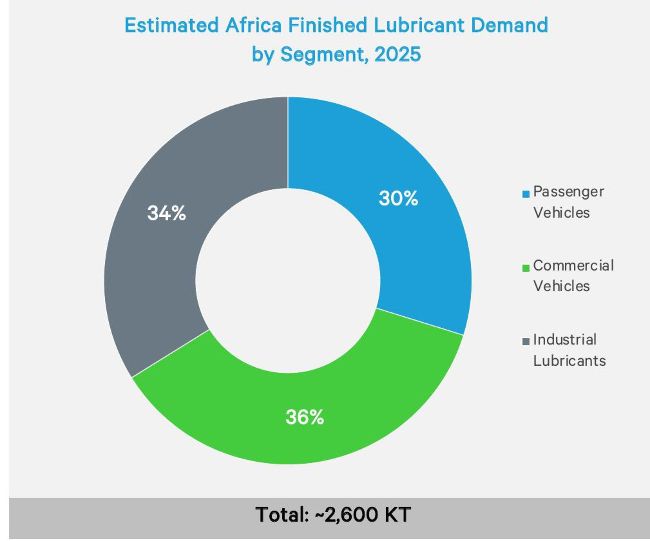

Africa finished lubricant demand is ~2,600 KT in 2025; automotive segment contributes to 66% of total share. Top 10 markets constitute around three quarters of the total market demand market commitment. Local blending builds credibility with governments and end users while enabling more flexible supply.

Source: Kline Analysis

© 2024 Kline + Company

• Some marketers are taking control of depots, transportation fleets, and even branded retail points. This gives them a tighter grip on stock availability, product handling, and brand representation.

• Digital transformation is accelerating this shift. Across Africa, smartphone penetration and e-commerce adoption are rising fast. Some lubricant marketers have introduced B2B ordering apps, digital loyalty programs, and telematics-based service alerts that connect workshops and fleets directly to suppliers for example (Ex- Egypt).

• We are also seeing creative partnerships emerge. TotalEnergies’ “Quartz Auto Service” model, for example, creates branded workshops that combine customer trust with controlled retail experience. Partnerships between lubricants suppliers and ride-hailing companies, logistics platforms, and fleet aggregators are also emerging and growing.

Segment-Specific Opportunities

The opportunities in Africa’s lubricants market span multiple segments, but each comes with distinct dynamics:

1. Automotive Lubricants: This remains the largest and fastest-growing segment. Africa’s vehicle parc is dominated by used imports, which tend to consume more lubricants and require shorter drain intervals.

Two-wheelers have become the lifeblood of urban mobility. They are cheap to run, easy to finance, and capable of navigating congested roads and rural tracks alike. Motorcycle oils now represent one of the fastest-growing lubricant segments in East and West Africa.

Marketers who ignore this segment do so at their peril. Brands that engage directly with motorcycle associations, mechanics, and informal service points can build massive loyalty through training, small incentive schemes, and mobile outreach campaigns

Trucks remain the backbone of Africa’s logistics system, carrying more than 70% of goods across borders and into rural markets. With limited rail infrastructure and inconsistent rehabilitation of existing lines, long-haul trucking is often the only viable mode of transport for all types of goods.

2. Industrial Lubricants: Mining, construction, cement, and manufacturing drive industrial demand. Here, success is less about price and more about technical services like oil analysis, condition monitoring, and efficiency optimization. As industrial operators seek to reduce downtime and extend equipment life, opportunities grow for technically competent suppliers.

3. Marine and Power Generation Lubes: Though smaller in volume, these niches are expanding with regional trade and the growth of electrification on one hand and the decentralized power systems on the other hand.

The Next Decade of Distribution

• Africa is entering a new era in lubricants distribution, one that rewards proximity, precision, and partnership. Companies that once relied purely on importers will need to move closer to the end user, invest in digital systems, and build trusted local relationships.

• The route to market is no longer about finding the right distributor; it’s about designing an ecosystem that connects producers, sellers, and consumers in a seamless, transparent flow.

• The brands that will lead over the next decade will be those that match global expertise with local adaptability and treat distribution not as an operational cost but as a strategic differentiator.

• Africa rewards those who get close to the customer. In this market, the route to market is a strategy. .

About the author: Samir is an Associate Project Manager at Kline and Company with over 17 years of specialized expertise in the lubricants market, particularly across the Middle East and Africa. He delivers comprehensive market intelligence, competitive analysis, and market-entry strategies for the energy sector.