COVER FEATURE

Advances in automotive lubricant design

Infineum anticipates future scenarios that are shaping tomorrow’s lubricants at ICIS London

The ICIS World Base Oils and Lubricants Conference is always packed with new ideas and innovations, while also providing a great platform for industry leaders to share their thinking. The 2025 event, held in London, was certainly no exception. Infineum Insight reports on the session from Sinead Adamski, Infineum Global Account Executive and EMEA Sales Director, exploring what is shaping future lubricant design and how innovative chemistry is supporting a more sustainable future for transportation.

Sinead Adamski at the ICIS World Base Oils Conference.

SOURCE | INFINEUM

The 29th ICIS World Base Oils and Lubricants Conference, held in London in February 2025, hosted more than 450 delegates and 50 expert speakers from across the supply chain. The event covered the latest in emerging technologies, data-driven insights, and sustainable solutions, with topics including alternative fuels, new mobility challenges and advances in lubricants and additives. In her session, Infineum’s Sinead Adamski showcased the various factors influencing automotive lubricant design.

“The automotive industry is currently going through a period of huge uncertainty,” Sinead explains. “Drivers for change include not only sustainability, legislative and geo-political forces but also pressure to cut costs and meet consumers’ changing preferences. The challenges these factors present are wide reaching, and in my view advanced lubricant developments will continue to be critical enablers for an automotive industry in the midst of an energy transition.”

But as Sinead continues, the pace and direction of change are not uniform across the world. “In the European market, we saw a significant acceleration in sales of electrically chargeable passenger car vehicles during the Covid pandemic but, more recently, the rate and pace have dropped. This decline in sales is down to a number of factors, not least the impact of the cost-of-living crisis, which means high vehicle purchase costs remain a barrier for many. In addition, the lack of charging infrastructure and range anxiety are also deterring consumers from buying full battery electric vehicles. What we are seeing here is a resurgence in the demand for hybrid vehicles, which mitigate some of these end-user concerns.”

In contrast, in China the share of electrically chargeable vehicle registrations has grown to more than 35% over the last few years, and latest figures suggest New Energy Vehicle (NEV) registrations have hit 65%.

The varied regional trends impact the demand and performance requirements for passenger car lubricants.

“At a macro level,” Sinead explains, “the trends in the development of high-performance lubricants continue to be influenced by tightening emission regulations, which are driving the adoption of sophisticated aftertreatment devices, and increasingly demanding fuel consumption targets that require specific adaptations in lubricant design. Governments and organisations have made ambitious net zero commitments, which bring new challenges and opportunities for green raw materials producers, supply chains and lubricant developers.”

“To meet their net zero and sustainability ambitions, vehicle OEMs are revising their strategies and introducing new innovations in engine design, electrification and fuel technologies. Zero emission vehicles are increasingly needed to meet fleet average CO2 targets and to address sustainability directives. This means OEMs must not only deliver fuel economy improvements from their engine design but also through a multitude of other approaches including hybridisation, alternative fuels, batteries and fuels cells. In my view, with the EU reviewing its commitment to ban Internal Combustion Engine (ICE) vehicles by 2035, there is the potential for a technology neutral pathway to net zero, which could open the door to exciting new innovations.”

“Some of the reasons driving change in automotive lubricants design include the push for sustainability, legislative and geo-political forces and pressure to cut costs while meeting consumers’ changing preferences.”

© 2025 Infineum International Limited. All rights reserved.

Sinead sees these changing trends, dynamics and OEM strategies playing through to the lubricants industry. “Lubricants need to deliver the level of performance modern engines need, whilst minimising emissions and providing fuel economy improvements. However, additional requirements such as reducing the carbon intensity of the lubricant, achieving more circular benefits and ensuring compatibility with new fuels, materials and driving cycles, all bring new formulation challenges. OEMs are under pressure to reduce costs in response to highly competitive market conditions, and consumers are managing tighter budgets, all of which mean the pressure to deliver sustainable, high-performance lubricants cost effectively, has never been higher.”

Lubricants as enablers of efficiency and sustainability

Sinead says that innovation will continue to be a critical enabler in the lubricant industry. “We need to build on the significant advances we’ve made over the last 50 years so that we can continue to reduce the environmental impact of chemical substances and enable the circular economy. While compliance with regulations is not new for our industry, new phenomena will need to be managed as engine designs change and lower carbon fuels and advanced chemistries are introduced, which may increase complexity in the supply, manufacture, marketing and distribution of lubricants.”

So, just what are some of technical impacts Infineum has seen recently and how are lubricants continuing to evolve? “Lower viscosity lubricants have been introduced to support fuel efficiency improvements in passenger cars, with SAE 0W-20 now the main factory fill grade. And, we are seeing this same trend, although at slower pace, in commercial vehicle applications. In modern engines, where engine tolerances are tighter and performance expectations in terms of lifetime and durability are even higher, it is vital that lower viscosity lubricants are formulated to deliver excellent wear protection.”

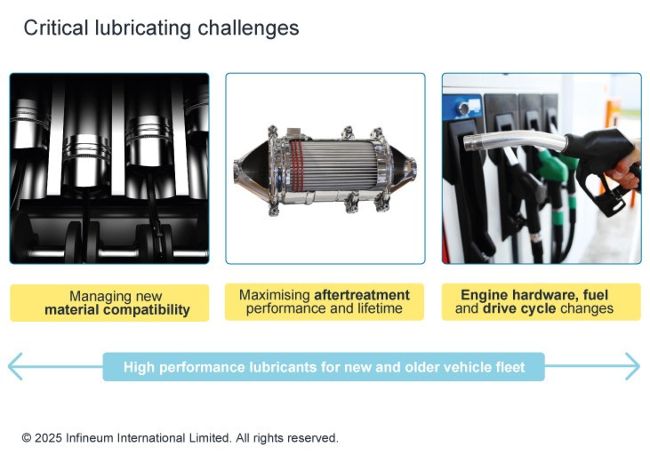

Although many of the critical lubricating challenges have not fundamentally changed, as Sinead explains, the vehicle application, engine design, aftertreatment hardware and driving regime are all impacting lubricant design. “The way we achieve peak performance in these different applications is changing. Today’s lubricants need to protect the engine while ensuring compatibility with a variety of different materials used in the bearings, pistons and coatings and a wider spectrum of alternative fuels. In addition, to optimise aftertreatment performance and

© 2025 Infineum International Limited. All rights reserved.

© 2025 Infineum International Limited. All rights reserved.

lifetime, further reductions in Sulphated Ash, Phosphorus and Sulphur (SAPS) will be required. And, on top of all these changes, as owners keep their vehicles for longer, cost effective lubricants are needed that can manage the challenging demands of an aging engine, which means the longevity of the required performance is essential.”

Protecting hybrid engines

In the passenger car market, full battery electric vehicles are seen by many OEMs as the best long-term strategy to meet CO2 emissions requirements. But, as Sinead reiterates, right now sales of hybrid electric vehicles are continuing to grow in many markets, bringing additional challenges for lubricants.

Hybrid operation puts subtly different demands on the lubricant, primarily due to the high frequency of engine stop/starts.

“In our experience, the high-power cold starts, and low temperature of the oil can lead to higher water content, which creates challenges including corrosion, rust and wear. Currently, no hybrid-only oil specifications exist. But, to ensure unique hybrid challenges can be fully addressed, many OEMs have added requirements to their traditional engine oil specifications. By anticipating the challenges and formulating oils to manage these conditions, we have been at the forefront of developing tailored products for hybrid driving regimes to meet the specific needs of our OEM partners.”

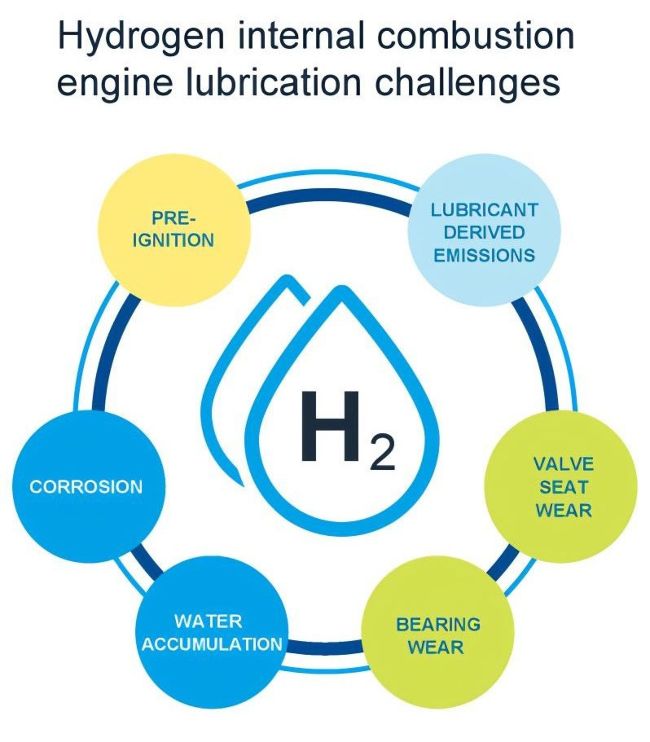

Fuelling the future

Electrification is not a one size fits all decarbonisation solution, and Sinead explains how things are different for heavy-duty applications. “One option being developed for large trucks is the Hydrogen Internal Combustion Engine (H2ICE), which has the ability to deliver the performance, CO2 reduction and power they need. We are already exploring what this means for engine oils so we can deliver against future performance needs. Some of the H2ICE challenges are not new, but the additive solutions to manage them, particularly to address the needs of mixed fleets, will require quite a different approach. Because hydrogen generates more than four times as much water as diesel, H2ICE lubricants will need to carefully manage emulsion formation, corrosion and rust challenges. In addition, we can expect that the potential for hydrogen pre-ignition is likely to be formulation defining.”

“The need for a lubricant to to minimise emissions, provide fuel economy improvements, reduce the carbon intensity of the lubricant, achieve more circular benefits and ensure compatibility with new fuels, materials and driving cycles present new formulation challenges.”

H2ICE lubricant specifications can be expected in the future although, as Sinead confirms, there are still a lot of unknowns. “It will be critical for production-ready hardware to be available to ensure the lubricants are tested with the correct materials and configurations. And we can expect the market to influence whether these lubricants will be bespoke or if multifuel capability will be needed to manage the complexity in the field.”

In my view, there will be a demand for specifically formulated H2ICE lubricants that can help to optimise performance, efficiency and cost.

“Looking ahead,” Sinead concludes, “I think the decades of experience we’ve gained, combined with sophisticated databases, modelling and testing will ensure we can meet the most challenging requirements. At the same time we will be working to anticipate and adapt our formulation approaches as the scenarios in the different transportation markets and regions unfold through the energy transition.“ .