ELECTRIC VEHICLEFEATURE

An electrifying market

EV ADOPTION

Acceleration of vehicle electrification as China continues to lead the electric passenger car market

F

or almost 10 years, China has been the world’s largest New Energy Vehicle (NEV ) market, and sales of electrified passenger cars are continuing to grow. In China, the Ministry of Industry and Information Technology has defined NEVs as vehicles that use new power systems and are completely, or mainly, driven by new energy. This includes pure Battery Electric Vehicles (BEV ), Fuel Cell Electric Vehicles (FCEV ) and Plug-in Hybrid Electric Vehicles (PHEV ), which also includes Range-Extended Electric Vehicles (REEV ). Unlike the definition in other regions, NEV in China does not include hybrid vehicles, which means it excludes start-stop, mild hybrid and full hybrid vehicles.

In 2023, almost 60% of the world’s new electric car registrations were made in China, confirming it as one of the most important NEV markets in the world. Of these electric vehicle registrations, BEV accounted for 70% and PHEV for the remainder.

Route to a fully electrified market

China has a long history of introducing measures to support the growth of NEV sales in the country. Back in 2001, the first announcement to develop NEV and promote it as a national strategy was published. More recently, in 2020, China released the ‘Energy-saving and New Energy Vehicle Technology Roadmap 2.0’ (hereafter: Roadmap 2.0).

China has along history of introducing measures to support the growth of New Energy Vehicle (NEV) sales in the country. Back in 2001, the first announcement to develop NEV and promote it as anational strategy was published.

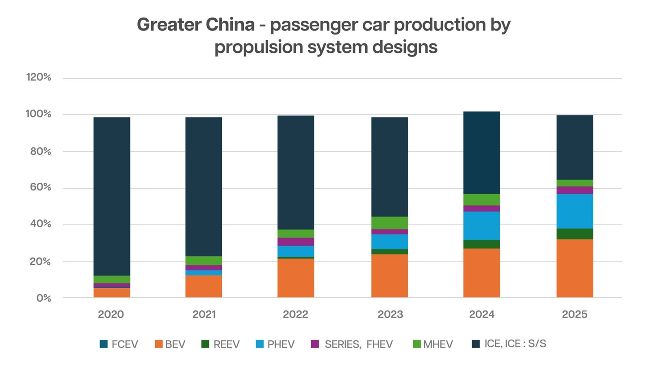

According to Roadmap 2.0, NEV penetration should rise to around 50% of total sales by 2035. However, in 2023 the NEV penetration of the China passenger vehicle market already touched 36%. Forecasts from S&P Global Mobility in Fig. 1 suggest this reached 46% in 2024, which means China would be close to achieving its 50% Roadmap 2.0 target 10 years ahead of plan.

Fig. 1 | Source: S&P Global Mobility, Light Vehicle Production based E-Propulsion Forecast, January 2025

Dual credit policy and subsidies boosted fast growing NEV market

China’s dual-credit policy adds a parallel management system that connects OEM’s fuel economy performance with NEV sales performance. The policy has set a series of certain credit requirements for automakers on their fleet fuel consumption reduction, under the CAFC regulation, and production of clean energy vehicles under NEV credits.

OEMs exceeding the system requirements earn extra credits, while falling short of the threshold results in deficits. Those who fail to meet their CAFC credits can offset their deficit with excessive fuel reduction through their positive NEV credits. If a carmaker’s NEV credit is negative, NEV credits can be purchased from other companies.

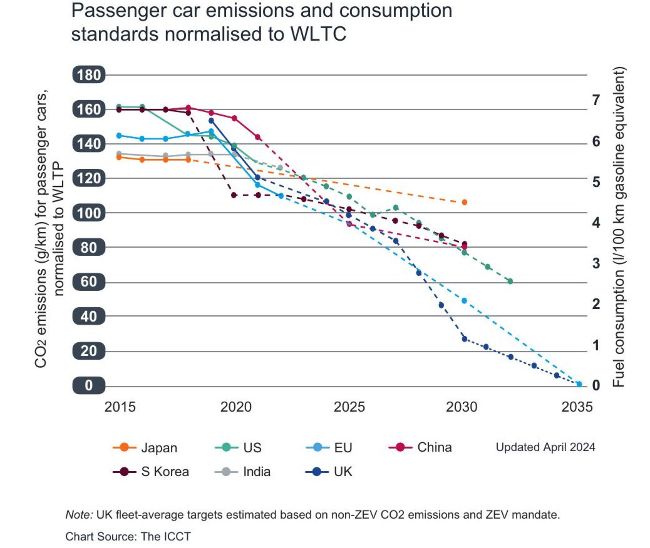

China’s government has introduced the CAFC regulation to reduce automotive fuel consumption. This applies to all vehicle models under each manufacturer, setting a fleetwide fuel consumption target and mandating a gradual reduction over the coming years. The compliance requirements and competition force OEMs to continuously adopt more advanced technologies to meet the requirements, with hybridisation being one of the major directions.

The chart above shows how the CO2 emissions and fuel consumption standards across some of the major markets are evolving.

Fig. 2 Chart above licensed under a Creative Commons Attribution 4.0 International license.Adapted from the original here -some data have been omitted.

In addition, in 2017, the government released an NEV credit regulation for OEMs to promote NEV models to the market as shown in Fig. 3.

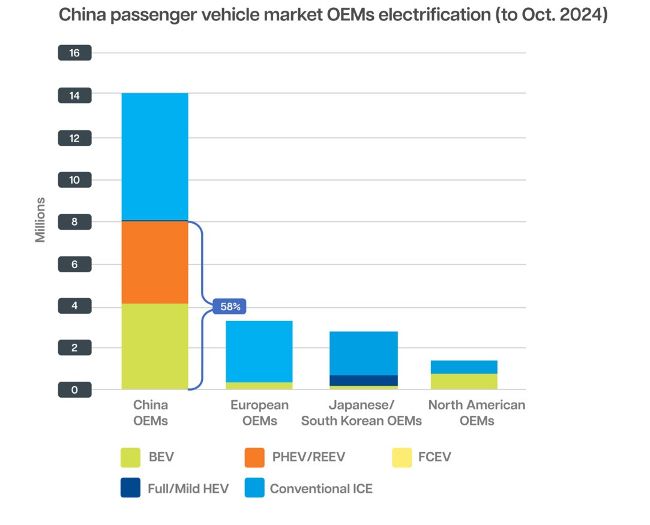

When looking at government NEV credit regulations, Chinese brands are taking a leading position in the overall passenger vehicle market and they are producing NEVs much faster than required by the regulation. The ratio of NEV sales are also much higher than for their global counterparts. See Fig. 4.

Subsidy policies are used in many countries to encourage the deployment of EVs and other cleaner energies. In China, the government released a subsidy policy to encourage consumers to purchase NEVs. The policy linked the size of the subsidy to technical features of the vehicles, such as electric range, battery size, efficiency, and battery density. NEVs have been sold at a price equal to the retail price reduced by the per-vehicle purchase subsidy amount, with the seller then receiving any subsidy payments from the central and local governments. The subsidy policy stopped at the end of 2022, however, NEVs sales in China have remained robust, indicating that the market is maturing.

Fig. 4 | Source: Marklines November 2024

NEV penetration across China varies by region

The climate is a key factor that affects consumer acceptance of NEVs, especially pure BEVs. The south of China, with a warm and humid climate, has a much higher acceptance of NEVs than north of China, where cold winters are challenging for battery performance. For example, Hainan province has a penetration of 60%+, while in the Northeast China it is relatively low. See Fig. 5

The number of available public charging piles is expected to reach 3.6 million by the end of 2024, which would account for some 70% of the global total. This wide availability of public charging piles in China has removed range anxiety concerns for consumers.

However, there are differences in the availability of charging piles between different areas across China. For some areas, such as in first-tier cities (e.g. Beijing, Shanghai, east/south China), extensive charging infrastructure means electrified vehicle penetration is higher here when compared to other areas of China.

Chinese consumer preference also helps to drive the transition

The rapid evolution in the electrification and smartification of the China passenger vehicle market is significantly shaping Chinese consumers’ preferences. In turn, the inherent voracious appetite of Chinese consumers for value and new trends is profoundly impacting the passenger vehicle industry, driving Chinese OEMs to increase their investment to refresh their portfolio and market offerings at a tremendous pace.

According to market analyst reports, smart features, such as improved autonomous driving and smart cockpit performance, are core reasons for Chinese consumers to buy NEVs. In addition, a growing number of Chinese consumers are reluctant to pay a price premium for Multinational Corporation (MNC) brands. These trends show that brands are less important to NEV consumers at present, with consumers more concerned about vehicle range and charging time, static and dynamic experience and vehicle operating and maintenance costs.

ICE hybridisation -one technology route for China OEMs

With the NEV market increasing, especially the PHEV/REEV segment, the ICE, as part of a hybrid platform, will still play an import role in the mobility transition. Next-generation powertrains will be shaped by increasingly strict global CO2 emissions legislation on one hand and altered mobility requirements of consumers on the other. Expectations that future powertrain systems should contribute to sustainable mobility are growing in urgency.

In an optimal hybrid drive, both the ICE and electromotive components can use their advantages to the full. When they team up, the result is not a compromise but real added value. Examples include higher performance via boosting, or all-wheel drive via P4 hybridisation. All with reduced CO2 emissions – and zero range anxiety. Forecasts from S&P Global show hybrid vehicles (PHEV/REEV ) production in China continues to increase over the coming years.

The strong performance of Chinese OEMs in NEV vehicle production - both BEV and PHEV - is helping them to continue to gain market share in China’s passenger car vehicle market.

By 2024, the market share of Chinese passenger car OEMs in China was forecast to exceed 60% as shown in fig.6.

Implications for the China lubes market

The NEV market in China will continue to grow in the coming years and we are seeing stronger growth in the PHEV/REEV segment. From 2021 to 2023, BEV grew at a Compound Annual Growth Rate (CAGR) of 50%, while PHEV/REEV experienced a CAGR of 120%. By October 2024, PHEV/REEV increased by 85% year on year, while BEV increased by 13%.

OEMs are likely to put resources and investment into the development of higher brake thermal efficiency engines, and dedicated hybrid engines. They will also be looking for lower friction lubricants to deliver more robust performance and improved water handling under extreme operating conditions in an increasingly complex multi-fuels future. Also, from the perspectives of Product Carbon Footprint (PCF) & Life Cycle Assessment (LCA) Analysis, more environment friendly lubricants will expand the scope of future evolution.

These include continued strong government support and promotion, consistent investment and innovation from OEMs and the broader industry, the rapid expansion of charging infrastructure, and growing consumer preference for NEVs. Together, these elements have positioned China as a global leader in the electric vehicle market, a status it is likely to maintain in the coming years.

These trends are bringing both challenges and opportunities across the automotive, lubricants, fuels and transportation additive sectors. Infineum continues to work closely with industry stakeholders to help ensure the success of the industry transition. .